T3 #003: Does carrying a balance increase your credit score?

I contacted 10+ friends in the past week to learn more about their financial journeys.

The top eyebrow raising thing that was said…

…I carry a balance because it improves my credit score.

“Huh?” 🤨

I had never heard about that before so I had to dive getting to the facts of it all.

Short answer: No, this is a myth.

Longterm carrying a balance can actually lower your credit score and cost you more if you are also affected with interest rates.

Best Practice: Pay off your credit card each month and use it as a way to pay with the money you already have not as a way to spend money you do not.

To figure out exactly how this can negatively impact you, we have to start with:

How does a credit score work?

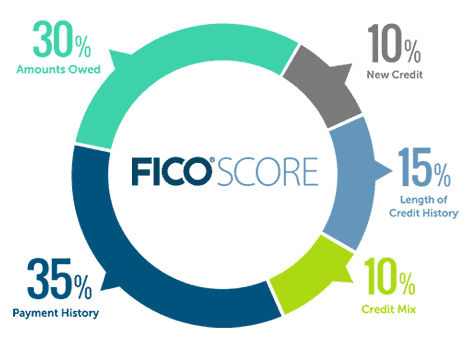

A credit score (or FICO score) is a mathematical equation that consists of five different factors:

- Payment History (35%). Pay your bills on time. The fastest way to decrease your score is missing a payment. AVOID at all costs.

- Amounts owed or Credit Utilization (30%). How much of your credit line do you use? If you have a $4,000 credit line and use $1,000 each month, that would be a 25% utilization rate. I personally keep this to 10% or lower.

- Length of credit history (15%). How many years have you had some sort of credit? This is why closing your oldest credit card can negatively impact your score.

- Credit Mix (10%). What types of credit do you have? Credit cards, retail accounts, loans, etc. DO NOT get a credit line simply for adding a ‘mix’ to your score.

- New Credit (10%). Opening new accounts and having what are called ‘hard pulls’ against your credit. A “hard pull” in an inquiry made to assess your risk before being approved for additional lines of credit. Every time you apply for a new credit card (like at the mall) or inquire for a loan (like a mortgage or car) can negatively drop your score.

Keeping each of those in balance results in a high credit score.

But notice → they are NOT equal.

Focus on factors that greatly impact your score, and less on the smaller ones.

Too often I hear people trying to optimize the 10%…

…when they consistently mess up the 30%.

Increasing your score is a slow process of good habits.

Patience is key. 🔑

Back to the initial questions:

How does carrying a balance impact my credit score?

There are two risks of doing this.

First risk. You can increase your credit utilization percentage month over month which can negatively affect your score.

Remember, that the Amount Owed/Credit Utilization category impacts 30% of the total score.

Second risk. You can miss an upcoming payment, especially if you do not use automatic payments.

This happened to one of my friends because they were camping with no cellular service.

BANG! Negative hit to their score.

And the Credit History category impacts 35% of the total score.

Remember, the key to all this money stuff is to SIMPLIFY the process as much as possible…

…we have enough of other things to worry about.

And I didn’t even mention the costs of interest you might be paying to carry a balance month over month.

Learn the tactics we should have learned in school without the trail-and-error.

Join me and 67+ subscribers to The Thursday Trailblazer. Every Thursday morning, you’ll receive 1 step-by-step insight to help you level up in the areas of personal finance or career development.