T3 #009: How to choose your “everyday” credit card

Keep your spending strategy simple.

This includes the credit cards that you use.

If you go to YouTube…

…you’ll find suggestions to use this card for this and that card for that.

But no one really wants to pull out a spreadsheet when they are just trying to buy their groceries.

For those that want to get into the fine print of credit cards, go for it!

For everyone else…

…here is how I choose the best credit card to use everyday.

Set a goal for your credit card use.

You may have a different goal for your credit cards, but I keep mine simple.

Nick’s Goal: Get the most amount of points or rewards with the least amount of thought needed.

My first step is identifying where do I spend my money.

Before I bought my house…

…my biggest expense was my monthly rent.

My second largest expense were groceries.

You can go into the weeds to get specific…

…but creating a high-level estimate for the past three months will give you a directional answer.

Here’s a quick spreadsheet you can populate with your estimates.

👉️ Choosing an “Everyday” Credit Card

I also updated it to show how many point rewards you’ll get each month with your spend with some of the more popular cards.

If you want to edit the sheet, you can make a copy of the Google Sheet.

The type of rewards matters as much as how many you might earn each month.

Imagine if I gave you a $1,000 to spend at an amazing restaurant that has one location in a remote part of Brazil.

Pretty useless?

The same goes with earning points on a credit card where you’ll almost never use to redeem.

I’ve seen this with hotel or airline cards.

What’s the point of having a ton of Southwest Airline points…

…if you never use them?

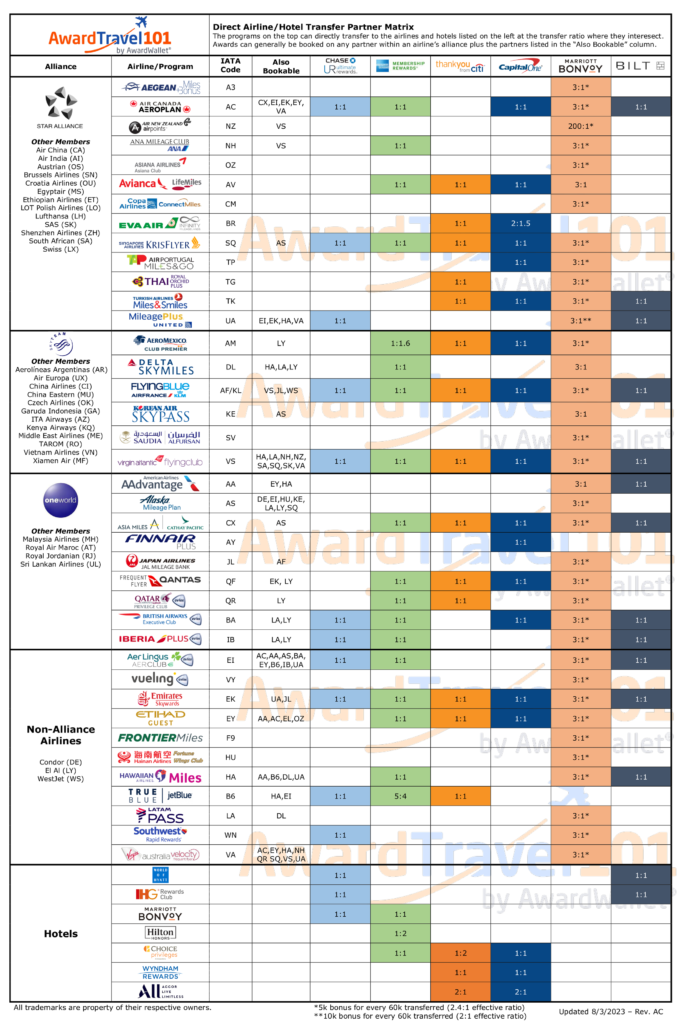

I personally focus on getting a credit card that provide bank-specific rewards with many transfer partners.

Award Travel 101 put together a really helpful chart to show where points can be transferred.

Transferring points to partners will typically allow you to redeem each point for more rewards than going through their specific redemption portals.

I go more into that in another article covering all things point hacking.

Summary of the steps to select the best everyday card.

Step 1: Determine how much you spend in each category

You can do this on the back of a piece of paper, on your own budgeting sheet, or your favorite money management app.

Having an estimate makes it easier to decide where which categories to focus on.

You can always input those expenses in this sheet for some quick estimates.

Step 2: Compare your potential earnings for each card

You can go to each credit card’s website to see how many points you’ll receive for each category.

Award Travel 101 also has a helpful Card Earning Chart if you want to see everything in one place.

Another thing to do note is that some cards have additional benefits, such as free TSA Pre-check or Lounge access.

For this exercise, we are not including those as those perks aren’t typically used every day.

Step 3: Select your card

Most people only have a couple of credit cards.

You do not want to overwhelm yourself with small details.

Happy point collecting! 😃

📚 Other Notable Resources

- Last Week’s Post: How to Sell Your Car for the Most Money

- Spreadsheet: Selecting the Best Everyday Card

- Maximize your point earnings: What is credit card point hacking?

Learn the tactics we should have learned in school without the trail-and-error.

Join me and 67+ subscribers to The Thursday Trailblazer. Every Thursday morning, you’ll receive 1 step-by-step insight to help you level up in the areas of personal finance or career development.