T3 #011: How much should I spend on a new car?

If you’re setting a monthly budget first…

…you’re probably overpaying.

You read that correctly.

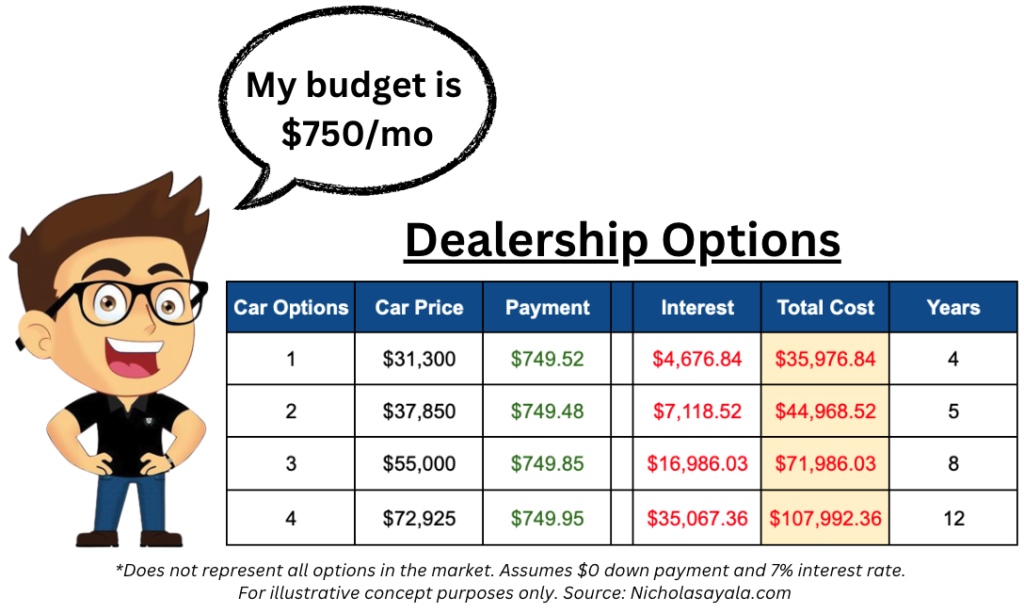

Walking in to a dealership with a $750 per month budget seems like all you would need to do.

But that is EXACTLY what the dealership wants you to think.

The dealership will take that number…

…and make almost ANY car fit within that budget.

How?

They will EXTEND the duration of the loan tfor that vehicle.

3 years or 36 months?

4 years or 48 months?

7 years or 84 months?

These are the numbers hidden in the fine print that most people just hit ‘accept’ and sign away.

Congratulations on your new car…

…and the 8 years of payments with only 7% interest!

Wait that’s for a new car…

…used car interest can be over 17% right now!

What are some common methods to consider when buying a car?

There isn’t a right answer to this.

When I make a large purchase for myself…

…my goal is to to have the least amount of time in debt where my payments should never put me in a financial strain.

Below we’ll dive into two common approaches:

Pay in Cash

or use the 20/4/10 Rule.

Method 1: Paying in Cash

Avoid car payments (and their interest)…

…by saving and buying a car in CASH.

That is the general approach preached by personal finance personality, Dave Ramsey.

This generally makes sense since most people will have to save for months.

Waiting and saving will really put the price and desires of that vehicle into perspective.

Could you imagine wanting a Mercedes G-Wagon?

Before taxes and any add-ons, they start at $139,000. 🫢

If you were saving $1,000 a month…

…that is over 139 months or 11.5 years of saving!

That quickly puts the price of some vehicles in perspective.

Just because you can, doesn’t mean you should. Some people fall upon the good fortune of a large sum of money, like inheritance, and think now they can afford a more expensive vehicle. They have the cash, so they are going to drain $50,000 on a new Tesla. DO NOT let this fog your mind!

Method 2: The 20/4/10 Rule

This is one of the most popular purchasing frameworks on the internet!

It’s also the one that requires a little bit of math.

Don’t worry…

…we’ll break this down together – and have a calculator for you to use.

Down payments should be 20% of the balance.

Loan should be no more than a four-year period (48 months).

The monthly expenses of loan payments, insurance, and gas should not exceed 10% of your monthly income.

Typing in some quick numbers…

…this usually is the most eye-opening to what a “responsible” budget for a car would be.

For example, if you made an annual salary of $75,000,

using the 20/4/10 Rule,

you’re monthly expenses shouldn’t exceed $625.

With a down-payment of $7,5000

You’re car budget would be $37,498.25.

The budget would actually be less with insurance and fees…

…however, this will get you very close in the range.

What did I do?

When my first car died in late-2019…

…I went into DEEP analysis mode.

I created a spreadsheet that tracked everything:

MPG, 10-year estimated maintenance cost, gas expenses, new, used, etc.

So many different considerations…

…that led me to a used Subaru Forester.

I didn’t know ANYTHING about Subaru at the time.

But it was within budget and mathematically was the best decision for my situation.

My plan now is to keep this car until it dies in 15+ years…

…and purely focus on investing in real estate to use the income from that to pay for my next car.

Yes, the Subaru will age.

But that is okay…

…especially when my future car is paid by income that I didn’t have to work a job for. 😃

📚 Other Notable Resources

- Last Week’s Post: How To Choose Which Debt To Pay First

- Free Resource: 20/4/10 Car Affordability Calculator

- Free Resource: Personal Budgeting Template (works for couples too!)

Learn the tactics we should have learned in school without the trail-and-error.

Join me and 67+ subscribers to The Thursday Trailblazer. Every Thursday morning, you’ll receive 1 step-by-step insight to help you level up in the areas of personal finance or career development.