The 5 Best High-Yield Savings Accounts for August 2023

Unlock the power of your savings with high-yield savings accounts.

Before I had opened my first high-yield savings account, I was getting anywhere from $0.01 to $0.30 per month in a normal checking or savings account.

That was fine because it was the only thing that I knew existed.

That was until I heard about high-yield savings accounts and now getting over $30 per month interest!

In this article, I’ve compiled some of the top high-yield savings accounts that I’ve found are safely FDIC-insured and provide consistent rates.

One thing to keep in mind is that the rates do rise and fall based on a variety of economic factors, so these rates may be different when you select a specific one.

Whether you’re just getting started or financially well-versed, I hope that you find the list helpful in optimizing earnings and making the most out of your savings.

What is a high-yield savings account?

A high-yield savings account (commonly abbreviated as “HYSA”) is like a regular savings account, but it’s a bit fancier because it offers you a better interest rate on your money.

When you put your money into a regular savings account, the bank gives you a small amount of extra money called interest.

A high-yield savings account gives you even more interest, which means your money can grow faster over time.

This past year, I was able to make over $450 in interest just for having my money sitting in a high-yield savings account!

You can decide to open an account with over 90 different financial institutions in the United States. Talk about decision overload! The methodology selecting the institutions below are evaluated on a number of factors.

Related: How to select the best high-yield savings account for me?

Best high-yield savings accounts

- Best of the Crowd Favorites: Marcus by Goldman Sachs – 4.30%

- Best For Simple Account Management: American Express High Yield Savings Account – 4.15%

- Best Uniquely Fun Approach: Yotta Savings – 2.70%

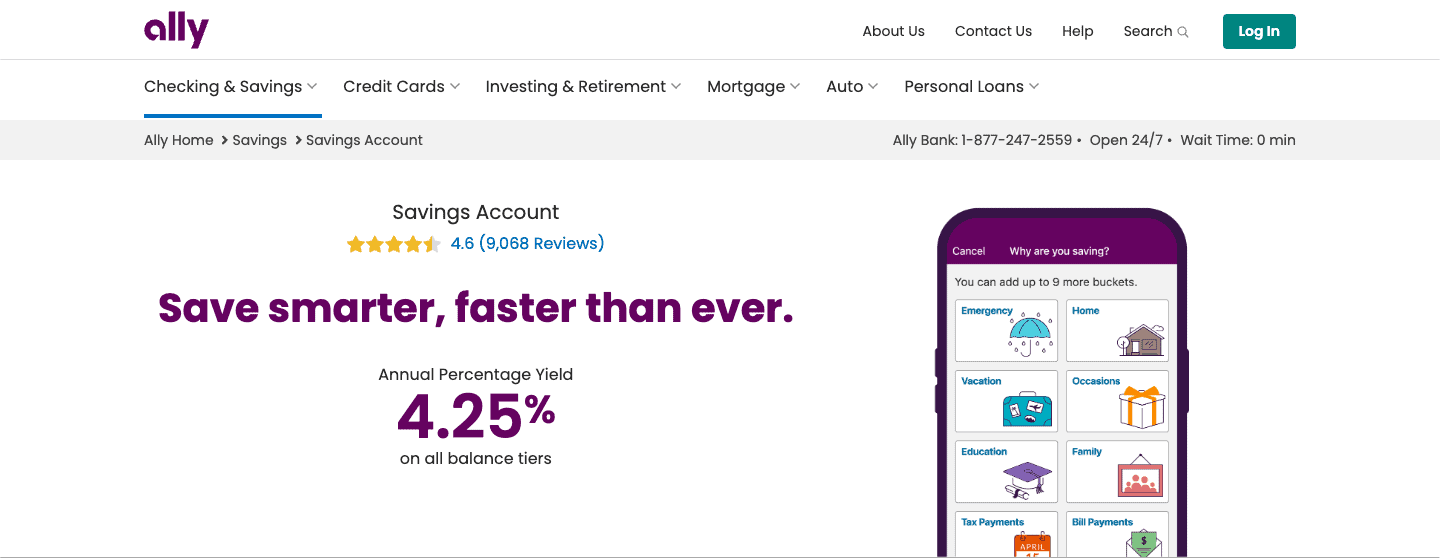

- Best Checking & Savings Combo: Ally Savings Account – 4.25%

- Best APY Savings Rate: UFB High Yield Savings – 5.25%

Best of the Crowd Favorites: Marcus by Goldman Sachs

Why this pick?

After speaking to a number of individuals about their high-yield savings account, Marcus by Goldman Sachs was one of the more popular options. Goldman Sachs has a strong, premium brand. I have found that some of the individuals that have opened a Marcus by Goldman Sachs account as an alternative to the AmEx High-Yield Savings Account to separate their investment and spending (credit card, liabilities) accounts.

About Goldman Sachs

Goldman Sachs, a renowned global financial institution founded in 1869, is a major player in investment banking, securities, and investment management. With a reputation for serving corporations, governments, and individuals, the firm offers a wide array of financial services. Its involvement in capital market activities, mergers and acquisitions, and asset management is notable.

While primarily recognized for its institutional services, Goldman Sachs also ventured into consumer banking with products like Marcus, an online platform offering personal loans and high-yield savings accounts. The firm’s extensive influence in global finance contributes to its prominent standing in the industry.

Aug 2023 Interest Rate: 4.30% APY

Benefits (Pros):

- Competitive Interest Rates: Marcus offers attractive interest rates, helping your savings grow faster compared to traditional savings accounts.

- No Monthly Fees: You won’t face monthly maintenance fees, ensuring that more of your earnings remain in your account.

- Easy Online Access: Manage your account effortlessly through Marcus’ user-friendly online platform, enabling convenient transactions and balance tracking.

- FDIC Insurance: Marcus high-yield savings accounts are FDIC insured up to the maximum limit, assuring the safety of your deposits.

- No Minimum Deposit: You’re not required to make a large initial deposit to open a Marcus account, making it accessible for various savers.

- Customer Support: The support team is known for being helpful and responsive, aiding in resolving queries or issues.

Cons:

- No Physical Branches: Marcus operates solely online, which might be a drawback for those who prefer in-person banking interactions.

- Limited ATM Access: Marcus doesn’t provide ATM cards for direct access to funds, requiring transfers to a linked checking account for spending.

- Variable Interest Rates: As with any high-yield savings account, interest rates can change over time, affecting your earnings.

- Transfer Limits: Federal regulations impose limits on certain types of transactions from savings accounts, potentially impacting your usage.

Takeaway

Marcus by Goldman Sachs is a solid option if you’re looking for a high-yield savings account with no frills. Simple with minimal complexity. Personally, that is exactly what I strive to have with my finances.

If you use my link below, Goldman Sachs will provide you an extra 1.00% APY for 3 months increasing the initial APY to 5.30%.

Best For Simple Account Management: American Express High Yield Savings Account

Why this pick?

This is the institution that I opened an account with for a number of factors. In 2018, when I first opened the account, American Express was offering a high-yield savings account with one of the highest interest rates that I could find. I also didn’t need to worry about managing another account login because I already had an Amex credit card.

About American Express

American Express, often known as AmEx, is a prominent financial services company recognized for its credit cards, charge cards, and travel-related services. With a history dating back to the 19th century, AmEx has established a reputation for offering premium services, catering to both consumers and businesses. While renowned for its credit offerings, it also provides banking solutions like high-yield savings accounts and certificates of deposit.

Operating primarily online, AmEx’s digital platform offers convenient access to financial products. However, it lacks physical branches. The company’s focus on quality customer service, rewards programs, and its iconic green, gold, and platinum cards have contributed to its global prominence.

Aug 2023 Interest Rate: 4.15% APY

Benefits (Pros):

- Competitive Interest Rates: AmEx High Yield Savings accounts often offer higher interest rates compared to traditional savings accounts, helping your money grow faster.

- No Monthly Fees: These accounts typically don’t have monthly maintenance fees, allowing you to keep more of your earnings.

- Easy Online Access: Manage your account conveniently online, including making transfers, checking balances, and setting up automatic deposits.

- FDIC Insurance: AmEx High Yield Savings accounts are FDIC insured up to the maximum limit, providing peace of mind that your money is protected.

- No Minimum Deposit: You might not need a large initial deposit to open an account, making it accessible for a wide range of savers.

- Automatic Savings Options: Set up automatic transfers to your AmEx High Yield Savings account from your checking account, making saving effortless.

- Flexible Withdrawals: While there are federal limits on the number of withdrawals, you can typically access your funds when needed.

Cons:

- Limited Physical Presence: American Express is primarily an online financial institution, which means there are no physical branches for in-person assistance.

- Limited Account Options: AmEx focuses mainly on savings accounts, so if you’re looking for a broader range of banking services, you might need to look elsewhere.

- Limited ATM Access: AmEx High Yield Savings accounts may not offer ATM cards for direct access to your funds, so you might need to transfer money to a linked checking account for spending.

- Customer Support: While online support is available, some customers might prefer in-person interactions, which are not possible with AmEx’s online-only approach.

- Transfer Limits: Federal regulations impose limits on the number of transactions from savings accounts, which can impact your ability to move money frequently.

- Variable Interest Rates: Interest rates on high yield savings accounts can change over time, potentially affecting your earnings.

Takeaway

If you already have an American Express credit card like myself, this might be an option to consider. I find it helpful to minimize the amount of account logins when possible to avoid forgetting where my money is.

Best Unique Approach: Yotta Savings

Why this pick?

Okay, this is one of the more “fun” options.

I learned about Yotta Savings on YouTube because it’s something new and different. It’s like a game where you save money. People in the United Kingdom have a similar thing called Premium Bond. With Yotta, you can have fun and save money at the same time. If you’re in the United States, it’s sort of like lotteries like the Powerball, but instead of losing the money you spend, it goes into your savings account.

About Yotta Bank

Yotta Bank is an online financial platform offering prize-linked savings accounts. It stands out by adding a gamified element to savings, allowing customers to win prizes through a weekly lottery based on their savings account balance.

With an average annual savings reward rate of 2.70% (expected rate, not guaranteed), Yotta incorporates an innovative approach to encourage saving and engage customers with a chance to win rewards.

How it works

- Open a Yotta Account & Deposit Funds. For every $25 you have in your account, you earn 1 ticket each and every day. (For example, $100 is 4 tickets every day!)

- Daily Drawings. Match your ticket numbers each day at 9PM EST.

- Win Prizes. Depending on how many numbers you matched, you could win $2,000, $20,000 or even the $1 Million Grand Prize!

Aug 2023 Interest Rate: 2.70% APY (expected, non-guaranteed)

The approximate Average Annual Savings Reward of 2.70% is a statistical estimate based on the probabilities of matching numbers each night. The Annual Savings Reward will vary from member to member depending on one’s luck in the Daily Drawings and is subject to change in the future.

Benefits (Pros):

- Gamified Saving: Yotta Savings account adds an exciting twist to saving by allowing users to participate in weekly prize lotteries based on their savings balance, encouraging consistent saving habits.

- High-Interest Earnings: With competitive interest rates, Yotta offers the potential for your savings to grow faster compared to traditional savings accounts.

- Digital Convenience: Yotta operates as an online platform, offering easy accessibility through its app, making it simple to manage your account on the go.

Cons:

- Risk of Not Winning: While the lottery aspect is fun, there’s no guaranteed reward, and not all users will win prizes. Some might not consider this a reliable method for growing savings.

- Limited Banking Services: Yotta focuses primarily on the gamified savings model and doesn’t provide the broader range of services that traditional banks might offer.

Takeaway

If you are someone that enjoys gamifying your life or an alternative to your weekly lottery plays, Yotta Savings might be an option to consider.

If you include my username “NICKMAYALA” when you sign-up, you’ll receive a Loot Box as a Welcome Gift. The Loot Box can contain up to $100 and bonus tickets.

Best Checking & Savings Combo: Ally Savings Account

Why this pick?

Ally Bank is one of the most popular online banking options. With one of the highest available high-yield savings accounts, that is actually only one of the reasons why Ally Savings made this list.

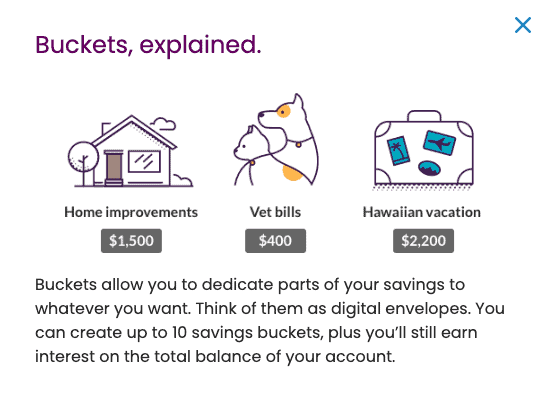

A unique feature of the Ally Savings account is the ability to create “Buckets.” As explained on the Ally Savings website, “Buckets allow you to dedicate parts of your savings to whatever you want. Think of them as digital envelopes. You can create up to 10 savings buckets, plus you’ll still earn interest on the total balance of your account.”

About Ally Bank

Ally Bank, established in 2009, is an online financial institution that offers a range of banking services including high-yield savings accounts and CDs. Known for competitive interest rates and no monthly fees, Ally provides accessible online banking tools.

While lacking physical branches, it emphasizes customer service and digital convenience. The bank’s offerings appeal to those seeking straightforward banking options with competitive rates.

Aug 2023 Interest Rate: 4.25% APY

Benefits (Pros):

- Competitive Interest Rates: Ally Savings accounts offer attractive interest rates, enabling your savings to grow faster compared to traditional savings accounts.

- No Monthly Fees: Ally doesn’t charge monthly maintenance fees, helping you keep more of your earnings in your account.

- Easy Online Access: With Ally’s user-friendly online platform and mobile app, managing your savings, making transfers, and checking balances becomes convenient.

Cons:

- No Physical Branches: Ally operates exclusively online, which might be a drawback for those who prefer in-person banking interactions.

- Limited Account Options: While Ally offers a range of banking products, it’s primarily focused on savings and checking accounts, so you won’t find as many services as some traditional banks.

- Variable Interest Rates: Interest rates on Ally Savings accounts can change over time, which might affect your earnings.

Takeaway

Ally Savings is a great option if you organize your finances using the envelope method. With many of the traditional banks requiring minimum deposits to avoid maintenance fees, it is often hard to organize your spending across different accounts. It was one of the primary reasons that I initially moved away from using Bank of America in the first place!

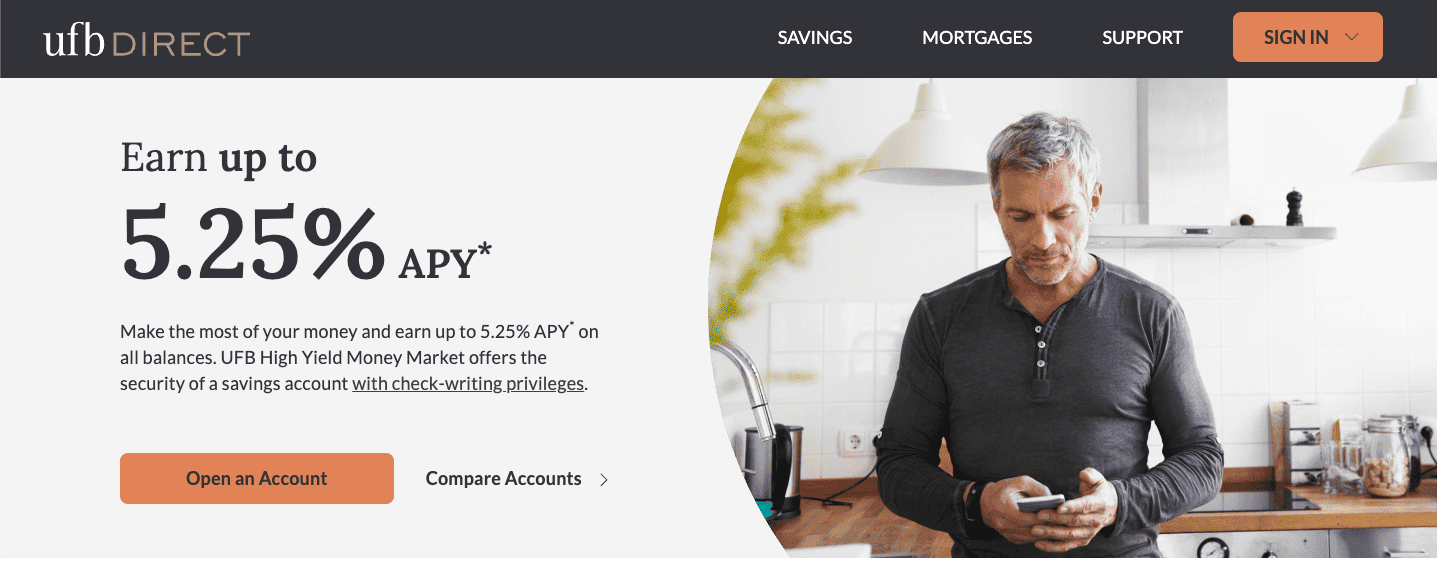

Best APY Savings Rate: UFB High Yield Savings

Why this pick?

Put simply, UFB High-yield savings has the highest Annual Yield Percentage (APY) of any of the financial institutions that I’ve researched.

About UFB Direct

UFB Direct Bank is an online financial institution offering high-yield savings accounts and certificates of deposit. With competitive interest rates and no monthly fees, UFB Direct emphasizes digital convenience for its customers.

While lacking physical branches, the bank focuses on providing accessible and straightforward online banking solutions for those looking to maximize their savings with competitive rates.

Aug 2023 Interest Rate: 5.25% APY

Benefits (Pros):

- Competitive Interest Rates: UFB Direct Savings accounts offer competitive interest rates, allowing your savings to potentially grow faster than with traditional savings accounts.

- No Monthly Fees: You won’t encounter monthly maintenance fees with UFB Direct, helping you retain more of your savings earnings.

- Online Convenience: UFB Direct emphasizes online banking, providing a straightforward platform for managing your savings, making transfers, and tracking balances.

Cons:

- Limited Account Options: UFB Direct mainly focuses on savings accounts and certificates of deposit, which might not offer the full range of banking services some traditional banks provide.

- No Physical Branches: Since UFB Direct operates entirely online, you won’t have access to physical branches for in-person assistance.

- Variable Interest Rates: Interest rates on UFB Direct Savings accounts can change over time, impacting your potential earnings.

Takeaway

If you are looking for the financial institution that offers the most generous high-yield savings account, UFB Direct Savings may be worth considering. Currently offering a 5.25% APY, this is almost 1.00% more than most of the others on this list. Do keep in mind, the current APY rate is variable and can change over time.

How do I choose the best high-yield savings account?

To select the best high-yield savings account, consider factors such as the offered interest rates, any associated fees, minimum balance requirements, and whether the account aligns with your financial goals. I’ve put together a guide including the various factors that I took into consideration when selecting the best high-yield savings account. I call it The Lifestyle Method to Select a High-Yield Savings Account.

What is the difference between a traditional savings account and high-yield savings account?

A traditional savings account offers lower interest rates and fewer requirements, while a high-yield savings account provides higher interest rates, allowing savings to grow faster. However, high-yield accounts might have stricter conditions and limited access compared to the more accessible nature of traditional accounts.

What should I use a high-yield savings account for?

When aiming to establish an emergency fund or gather funds for significant expenses like a home down payment or a car, opting for a high-yield savings account can accelerate your progress towards achieving these objectives.

Summary

High-yield savings accounts offer a remarkable opportunity to boost your savings like never before. Shifting from minimal earning pennies to dollars per month can significantly add up over time. This article has curated a selection of FDIC-insured options with reliable rates, catering to a spectrum of savers. While rates fluctuate due to economic factors, this compilation serves as a valuable guide to enhance your financial journey.

Whether you’re a novice or a seasoned saver, these accounts can prove instrumental in maximizing your savings potential.

Learn the tactics we should have learned in school without the trail-and-error.

Join me and 67+ subscribers to The Thursday Trailblazer. Every Thursday morning, you’ll receive 1 step-by-step insight to help you level up in the areas of personal finance or career development.

One Comment

Comments are closed.